Russian banks have been permitted by the RBI to open special Vostro accounts to pave the way for rupee-based export-import transactions. Loro accounts are generally held by a 3rd party bank, other than the account maintaining bank or with whom account is maintained. Some banks might hold checks that whole $1,500 or greater for as many as 10 days. The number of days the financial institution holds these checks is determined by your relationship with the institution. Simply our money in your bank denoted in your domestic currency. Closely monitored nostro accounts can be used for better reconciliation of statements.

In India, high proportion of micro and small businesses are unregistered. Under it the Central Government can regulate the flow of payments to and from a person situated outside the country. BOI wants to transact with HSBC, but doesn’t have any account, while SBI maintains an account with HSBC in U.K. Eg – OBC wants to transact with HSBC, but doesn’t have any account, while SBI maintains an account with HSBC in U.K.

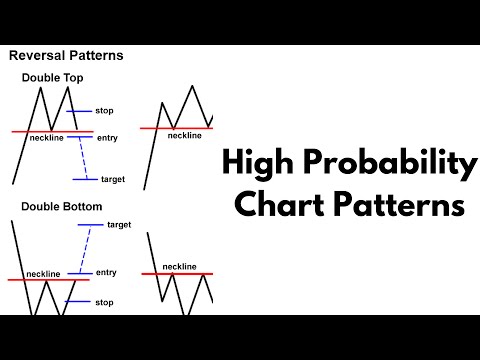

A Vostro Account is one that is once again administered by a correspondent bank on behalf of another bank. Under the aforementioned rupee payment mechanism, Indian exporters may get advance payments in Indian rupees from foreign purchasers against exports. Several SRV accounts for various banks from the same nation may be opened by authorized banks. The second approach to analyse securities is Technical Analysis. According to this, past movement in the prices of shares are studied to identify the trends and patterns in prices of securities and to predict the future price movements, immediate past patterns is considered.

Current Affairs 24 March 2023

This type of commission doesn’t provide protection to the consignor from bad debts. In commodity market, prices get influenced by many factors from monsoon predictions to political decisions. To provide financial information which increase the reliability of users. To give factual and interpretative information about transactions and events. To provide information to investors and creditors for prediction, comparison and evolution.

- Here we are creating quiz covering important questions which are common for all the bank exams and other competitive exams.

- For over 25 years, Fexco has been providing quick, safe and value-effective international and domestic money transfers for business and private prospects.

- In simple words, if any foreign bank opens an account with an Indian bank in rupees.

- Nostro accounts are denominated in the foreign foreign money of the correspondent financial institution.

- So, selection of best securities is the important activities in portfolio management.

- Now the Indian company wants to seek payment for the services rendered to the American Company.

So the ‘Vostro Account’ of the foreign bank with Indian bank in India is said as ‘YOUR Accounts with Us’. Home Currency of one country is foreign currency for other country. Conversion of foreign currency in to home currency is the fundamental of foreign exchange.

“Hawala transactions” in India are prohibited under the provision of Foreign Exchange Management Act. Here we are creating quiz covering important questions which are common for all the bank exams and other competitive exams. ASPIRE IAS specialises in all three stages of Civil Services preparation. Here, we provide best quality education at the best price with the aim of spreading an EDUCATION REVOLUTION. Read More.

This account serves as an economic way for small domestic banks to access the financial resources and services of a larger foreign bank. When a bank maintains its foreign currency account in a bank in a foreign country in the local or home currency of that country it is called a “Nostro” account. NOSTRO accounts are one of the ways that banks manage their foreign currency exposure and facilitate international transactions for their customers. A Vostro account is a balance held in the domestic currency of the domestic bank—in this case, the rupee—for the benefit of the foreign bank. This account is the account which is held by a domestic bank [ex.-Indian bank] with foreign bank [ ex.-bank in Switzerland].

Advantages of Nostro and Vostro Accounts

Since, many a time foreign exchange transaction becomes little cumbersome, to provide a better facility in making international transactions banks maintain these type of three current accounts. The commandable growth in international trade over a few decades has redefined the structure of international financial markets. The augmentation and expansion of trade rests on an effective and efficient financial market. Over a period of time, they have conveniently mutated from the traditional role of accepting deposits and lending money to acting as intermediaries in facilitating trade within as well as across countries.

LORO account is the opposite, which means an account that one bank holds with another or third-party banks. Also, it would lessen the necessity for keeping foreign exchange reserves and the reliance on foreign currencies, reducing the vulnerability of the nation to outside shocks. In order to nostro vostro loro start an SRVA, banks from partner nations must first approach an authorized domestic dealer bank, which will then request permission from the top banking authority. Vostro account refers to the account that is held by a bank which allows customers to deposit money on behalf of another bank.

Therefore, Banks generally use Nostro Account to make any transaction with other parties in a foreign country where there is no physical presence, and in foreign currency. The terms Nostro and Vostro are used in the bilateral correspondence between the concerned two Banks ie the Bank maintaining the account and the Bank in whose book the account is maintained. But in such correspondence when third bank account is referred it is said as LORO account. For example when XYZ bank of India is maintaining an account with ABC Bank in New York USA in USD when PQR bank of India refers the said account in correspondence with XZY Bank, Now YORK it is said LORO account . Domestic importers must pay the bills for the supply of goods or services from the international seller/supplier into the SRVA account of the correspondent bank.

In this regard, three types of accounts come into play- Nostro, Vostro, and Loro. It’s 2017 and most financial transactions at the moment are completed on-line. So why is it that transferring finances internationally isn’t an instantaneous process? Transfers transfer in a series of steps that are purposely slowed down to be able to cut back the potential for fraud. Each nation has guidelines surrounding the motion of money via its worldwide borders.

Similarly, when the Indian Banks makes the payment from its Nostro A/C, the Australian Bank debits the Nostro A/C of the Indian Bank. Therefore, Banks generally uses these three terms in terms of international transactions. Usefulness of any foreign Currency can be had only if it is converted in to home currency because, foreign currency is not used or acceptable in India if we take example of India. For giving usefulness to any foreign currency the said currency needs to be converted in to the home currency. Small accounts are valid for a period of 12 months initially which may be extended by another 12 months if the person provides proof of having applied for an Officially Valid Document. According to the Bureau for International Settlements Triennial Central Bank Survey 2022, 88% of all transactions are conducted in U.S. dollars.

For better understanding what is Foreign exchange transaction, we need to understand first what is ‘home currency’ and what is ‘foreign currency’. The total of debits by way of cash withdrawals and transfers will not exceed ten thousand rupees in a month for BSBDA small accounts. Mutual fund creates an important investment opportunity for small investors who do not have knowledge about market and face a lot of problems in taking investment decision because of volatile market. In 1978 it came under the control of the Industrial Development Bank of India and Unit Scheme 64 was the first scheme of UTI in 1964. This account is the account of one country’s bank with another country’s bank .

Banking Awareness : Non Performing Assets (NPA)

To understand better, XYZ Bank in Australia wants to conduct business in India and needs to hold Indian Rupee, it can open a NOSTRO account with Bank ABC in India. Bank XYZ can then use the NOSTRO account to facilitate transactions in Indian Rupee without having to convert the Australian dollar into Indian Rupee every time it needs to make a transaction. Maximum balance in the BSBDA small account should not exceed fifty thousand rupees at any time. One can have Term/Fixed Deposit, Recurring Deposit etc., accounts in the bank where one holds ‘Basic Savings Bank Deposit Account. Latin terms that mean “ours” and “yours,” respectively, are Nostro and Vostro.

Vostro Account

Now let us look at the differences between Nostro and Vostro accounts. You will receive a link and will create a new password via email. The Act empowers RBI to place restrictions on transactions from capital Account even if it is carried out via an authorized individual.

Nostro, Vostro and Loro Accounts

All reporting of cross-border transactions are to be done in accordance with the extant guidelines under the Foreign Exchange Management Act , 1999. The framework entails three important components, namely, invoicing, exchange rate and settlement. When the two banks have Nostro Account with a third bank then in this scenario Nostro Account of one bank with a third bank would be a Loro Account for another bank. For Example, if the Bank of Japan and Bank of India have Nostro Accounts in Bank of America.

The account is opened by a bank so as to facilitate easy clearing of their transactions in the foreign country. A bank typically opens a Nostro account in one other bank in another country where there’s numerous foreign exchange transactions on a periodic basis. These accounts usually are not opened in nations which are on the restricted list or the place there is a minimal quantity of foreign trade transactions taking place. Alternatively, for different banks, it is going to be thought of as a Vostro account i.e your account in our books of accounts. Banks within the United Kingdom or the United States usually maintain a Vostro account on behalf of a international financial institution.

Comments